You have some capital, researched, and found some business ideas. Now, you’re ready to take the next step toward entrepreneurship.

However, before diving headfirst into your dream venture, a crucial decision to make is choosing the right business entity. This seemingly small detail can impact your startup in several aspects, including management, taxation, personal liability, and more.

To help you, let’s explore the different business entity options so you can select the one that best suits your needs.

Understanding Different Business Entities

A recent study established that 42% of Americans have considered starting their businesses.

There’s no one-size-fits-all solution when it comes to which business entity is best for a startup. Here’s a breakdown of the most common choices for startups, along with their key features:

Sole Proprietorship

A sole proprietorship is the simplest and most common form of business entity. Since it’s owned and operated by a single individual, there’s no distinction between the owner and the business.

It offers no liability protection, meaning your assets are on the line if the business incurs debts.

Advantages

- Easy to establish and maintain with minimal legal and administrative requirements

- You have complete control over all business decisions and operations

- You report income on your tax return, simplifying the tax process

Disadvantages

- It has unlimited personal liability, meaning you’re liable for all business debts and obligations. This can put your personal assets at risk

- You may find it challenging to raise capital, as you cannot sell stock and may have limited borrowing capacity

Partnership

When you team up with one or more individuals and share ownership of the business, that becomes a partnership.

Partnerships offer shared responsibilities and growth potential and can be:

- General Partnerships – all partners share full responsibility for the business

- Limited Partnerships – some partners have limited liability or debts and limited involvement in management

Here’s how these differ

Advantages

- You can divide tasks and responsibilities with your partner, leveraging complementary skills and expertise

- There’s potential access to more resources and quick growth with more than one owner

- Your partner can provide valuable motivation and emotional support, especially during challenging times

- Partners bring their own networks and business connections to the table. This expands the partnership’s reach and potential customer base

Disadvantages

- General partners are personally liable for business debts and obligations

- There’s potential for disagreements between partners can arise, leading to conflicts and disruptions in business operations

Limited Liability Company (LLC)

According to the Govdocfiling LLC registration guide, an LLC is a hybrid business entity that provides the features of both partnerships and corporations. It offers limited liability protection just like a corporation, but with pass-through taxation like a partnership.

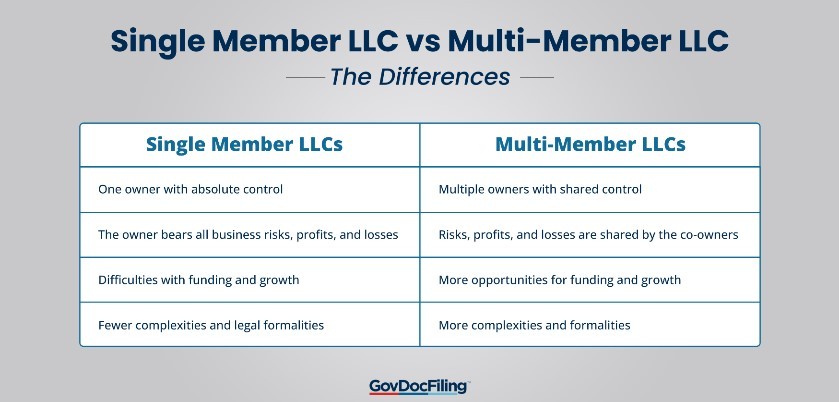

LLCs come in two types:

- Single Member LLC – Has a single owner with total control

- Multi-Member LLC – Has multiple owners who share control

Here are the main differences between the two LLCs

Advantages

- You aren’t personally liable for debts and liabilities the business incurs

- Unlike rigid corporate structures, LLCs allow you to choose how you manage the business and distribute profits among members

- They avoid double taxation by passing through profits and losses to members’ tax returns

Disadvantages

- You’ll deal with more paperwork and formalities than sole proprietorships and partnerships

- Some states have specific regulations, fees, or annual taxes for LLCs. For instance, while Texas doesn’t require LLCs to pay to file annual reports, you’ll pay $350 annually in Nevada

Corporations

A corporation is the most formal business entity. It’s a legal entity separate from its owners, offering limited liability for shareholders who own a portion of the company.

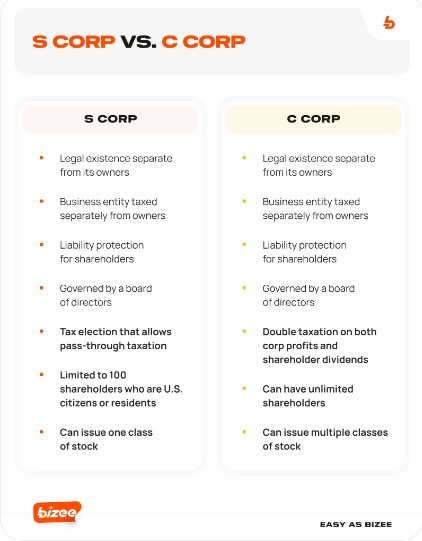

You can choose between:

- C Corporations – These are the default types of corporations, subject to double taxation but with more flexibility with stock and benefits for employees

- S Corporations – These enjoy pass-through taxation but have limitations on who can own them

Here’s how they differ

Advantages

- Shareholders are not personally liable for business debts and obligations

- Corporations can issue stock, making it easier to raise funds from investors

- A corporation keeps going even if the owners change or leave

- Corporations can create clear hierarchies and appoint qualified managers, leading to more efficient operations and better decision-making

Disadvantages

- C Corporations experience double taxation

- Corporations must comply with more rigorous regulations and reporting requirements

- Corporations can have complex ownership structures with multiple classes of stock and separate management. Making vital decisions and aligning the business with shareholders’ interests can be challenging

How To Choose the Best Business Entity for Your Startup

Here are several key factors to consider when choosing the right business entity for your startup:

- Liability Protection – It’s crucial to shield your assets from business debts and lawsuits, especially in high-risk industries

- Taxation – Pass-through taxation allows profits and losses to flow to the owners’ personal tax returns, avoiding double taxation. This is a benefit of sole proprietorships, partnerships, and LLCs.

- Ownership and Control – Sole ownership gives full control but limits capital and expertise contributions. On the other hand, shared ownership allows multiple contributors but needs clear agreements on decisions and profit distribution

- Funding Options – Consider how you plan to raise capital and which entity type best supports these plans.

- Long-Term Goals – Simple structures like sole proprietorships and partnerships suit businesses with limited growth plans. LLCs and corporations offer the scalability and structure needed for growth and expansion

The Key Takeaway

Now you know the various business entities at your disposal. Choosing the right structure is a foundational step that affects your business’s long term.

Carefully weighing each entity’s pros and cons will help you match your business structure with your goals. Now, go forth and build your business empire.

⸻ Author Bio ⸻

Brett Shapiro is a co-owner of GovDocFiling. He had an entrepreneurial spirit since he was young. He started GovDocFiling, a simple resource center that takes care of the mundane, yet critical, formation documentation for any new business entity.