The world of cryptocurrency has evolved from a niche technology experiment into a mainstream financial asset class that millions of people worldwide are exploring. Whether you’re intrigued by Bitcoin’s potential as digital gold, Ethereum’s smart contract capabilities, or the broader promise of decentralized finance, taking your first step into crypto begins with understanding how to convert your traditional currency into digital assets. This comprehensive guide will walk you through everything you need to know about buying cryptocurrency safely and confidently.

Understanding the Basics: What Does Buying Crypto Really Mean?

Before diving into the purchasing process, it’s important to understand what you’re actually buying when you acquire cryptocurrency. Unlike traditional stocks or bonds, cryptocurrencies are digital assets that exist on blockchain networks, which are decentralized ledgers that record all transactions across a distributed network of computers. When you buy crypto, you’re essentially purchasing units of these digital currencies that you can store, trade, or use according to the specific cryptocurrency’s functionality and your investment goals.

The process of buying cryptocurrency involves exchanging your fiat currency (such as US dollars, euros, or British pounds) for digital tokens through various platforms and services. These platforms act as intermediaries that facilitate the conversion, ensuring you receive your purchased cryptocurrency in a secure digital wallet. Understanding this fundamental exchange is crucial because it helps you recognize the importance of choosing reputable platforms and maintaining proper security practices throughout your crypto journey.

Choosing Your Entry Point: Cryptocurrency Exchanges and Payment Platforms

The cryptocurrency market offers multiple pathways for purchasing digital assets, each with distinct advantages depending on your needs and experience level. Centralized cryptocurrency exchanges like Coinbase, Binance, and Kraken have become popular choices for both beginners and experienced traders, offering extensive coin selections, advanced trading features, and robust security measures. According to Statista, the global cryptocurrency market is projected to generate US $85.7 billion in revenue in 2025, with a compound annual growth rate (CAGR) of 11.01% expected to push that figure to US $95.1 billion by 2026. The number of users is forecast to reach nearly 963 million worldwide by 2026, highlighting the sector’s continued expansion and mainstream adoption. These platforms typically require account verification, which involves providing identification documents to comply with financial regulations, but they offer the benefit of integrated wallets and user-friendly interfaces.

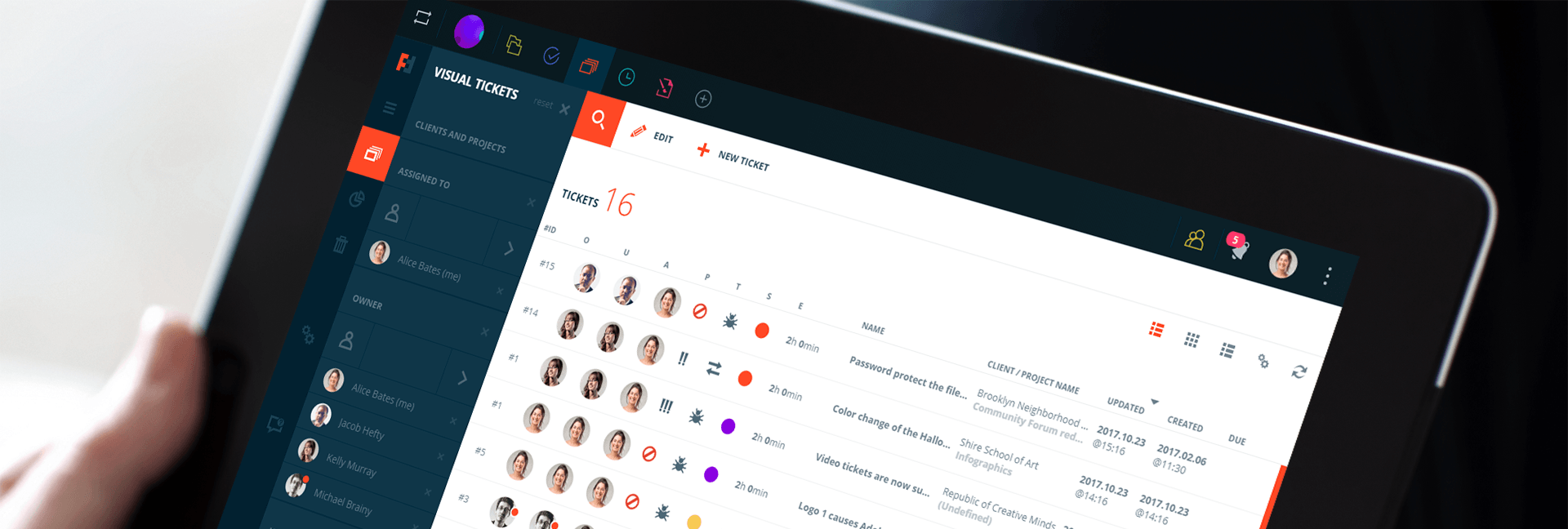

For those seeking a more streamlined experience, payment platforms like MoonPay provide simplified solutions to buy crypto directly using credit cards, debit cards, or bank transfers without the complexity of navigating full-featured exchanges. These services bridge the gap between traditional finance and cryptocurrency by offering instant purchases with minimal setup requirements. The advantage of using dedicated payment platforms is their focus on user experience: they eliminate the learning curve associated with exchange interfaces while still providing access to popular cryptocurrencies like Bitcoin, Ethereum, and numerous altcoins.

Peer-to-peer (P2P) platforms represent another option where you can buy cryptocurrencies directly from other individuals, often with more payment method flexibility and privacy considerations. While P2P platforms can offer competitive rates and diverse payment options, they require more caution regarding transaction security and typically suit users who have some familiarity with cryptocurrency transactions and best practices for safe peer-to-peer trading.

Step-by-Step: Your First Cryptocurrency Purchase

Beginning your cryptocurrency journey requires following a systematic approach to ensure security and success. First, research which cryptocurrency aligns with your investment thesis or intended use. Bitcoin remains the most established and widely recognized, while Ethereum offers exposure to the smart contract ecosystem, and various altcoins provide specialized functionalities or investment opportunities. Understanding your purchase motivations helps you make informed decisions about which digital assets deserve your capital.

Next, select your purchasing platform based on factors including supported cryptocurrencies, fee structures, payment methods, geographical availability, and security reputation. Compare several options to find the best fit for your specific circumstances, paying attention to transaction fees, exchange rates, and processing times. Many platforms offer mobile applications alongside web interfaces, providing flexibility in how you manage your purchases and holdings.

After choosing your platform, complete the registration and verification process, which typically involves providing personal information, uploading identification documents, and sometimes completing facial recognition checks. While this process might seem invasive, it’s a regulatory requirement in most jurisdictions designed to prevent fraud and money laundering. Once verified (which can take anywhere from minutes to several days depending on the platform), you can fund your account using your preferred payment method and execute your first purchase by specifying the amount of fiat currency you want to convert or the quantity of cryptocurrency you wish to acquire.

Securing Your Investment: Wallet Basics and Best Practices

After purchasing cryptocurrency, understanding proper storage becomes paramount to protecting your investment from theft or loss. When you buy crypto through an exchange or payment platform, your digital assets are initially stored in a custodial wallet controlled by that platform. While convenient for active trading, leaving large amounts in custodial wallets exposes you to platform-related risks including hacks, insolvency, or operational failures that could result in losing access to your funds.

For enhanced security, consider transferring your cryptocurrency to a personal wallet where you control the private keys, which are the cryptographic codes that prove ownership and enable transactions. Software wallets installed on your computer or smartphone offer a balance between security and convenience, while hardware wallets (physical devices designed specifically for cryptocurrency storage) provide the highest level of protection against online threats. The popular saying in crypto communities, “not your keys, not your coins,” emphasizes the importance of self-custody for long-term holdings.

Implementing security best practices is non-negotiable in the cryptocurrency space where transactions are irreversible and recovery options are limited. Enable two-factor authentication on all accounts, use strong and unique passwords, maintain secure backups of recovery phrases in multiple physical locations, and remain vigilant against phishing attempts and social engineering attacks. Never share your private keys or recovery phrases with anyone, and be skeptical of unsolicited investment advice or promises of guaranteed returns, which are common tactics used by scammers targeting cryptocurrency newcomers.

Navigating Costs: Understanding Fees and Tax Implications

Buying cryptocurrency involves various costs beyond the purchase price itself that can significantly impact your investment returns. Transaction fees vary widely across platforms. Exchanges typically charge trading fees ranging from 0.1% to 2% per transaction, while payment processing services might charge slightly higher fees for the convenience of instant purchases with credit or debit cards. Additionally, network fees (also called gas fees, particularly on Ethereum) apply when transferring cryptocurrency between wallets, with costs fluctuating based on network congestion and transaction complexity.

Understanding these fee structures helps you make cost-effective decisions about when and where to buy cryptocurrencies. Some platforms offer fee discounts for higher trading volumes or holding their native tokens, while others provide promotional periods with reduced fees for new users. Calculating your total cost of acquisition (including all applicable fees) gives you a more accurate picture of your actual investment and helps you set realistic expectations for profitability.

Tax considerations represent another crucial aspect of buying and holding cryptocurrency that many newcomers overlook. In most jurisdictions, cryptocurrency transactions trigger tax reporting obligations, with rules varying significantly by country. The United States, for example, treats cryptocurrency as property, meaning every transaction (including converting crypto back to fiat, trading one cryptocurrency for another, or even using crypto to purchase goods) could generate taxable events. Maintaining detailed records of all purchases, sales, and transfers from the beginning simplifies tax reporting and helps you avoid penalties or audits down the line.

Making Informed Decisions: Research and Risk Management

Successfully navigating the cryptocurrency market requires ongoing education and careful risk management rather than impulsive decision-making based on hype or fear. Before buying any cryptocurrency, research its underlying technology, use cases, development team, community support, and competitive landscape. Read the project’s whitepaper, follow reputable news sources and analysis platforms, and engage with educational resources to build genuine understanding rather than relying solely on price predictions or social media sentiment.

Implementing sound risk management principles protects you from the cryptocurrency market’s notorious volatility and helps you make rational decisions during periods of market euphoria or panic. Only invest amounts you can afford to lose completely, diversify across multiple cryptocurrencies rather than concentrating everything in a single asset, and avoid using leverage or borrowed money for crypto purchases. Setting clear investment goals, establishing entry and exit strategies, and maintaining emotional discipline during price swings all contribute to long-term success in the digital asset space.

The journey from fiat currency to cryptocurrency ownership represents more than a financial transaction. It’s an entry point into a transformative technology ecosystem that continues to evolve and expand. By following these guidelines, conducting thorough research, prioritizing security, and maintaining a measured approach to risk, you position yourself to participate meaningfully in the cryptocurrency revolution while protecting your financial interests. Whether you’re buying your first fraction of Bitcoin or exploring diverse altcoin opportunities, the knowledge and practices outlined in this guide provide the foundation for a successful cryptocurrency investment experience.