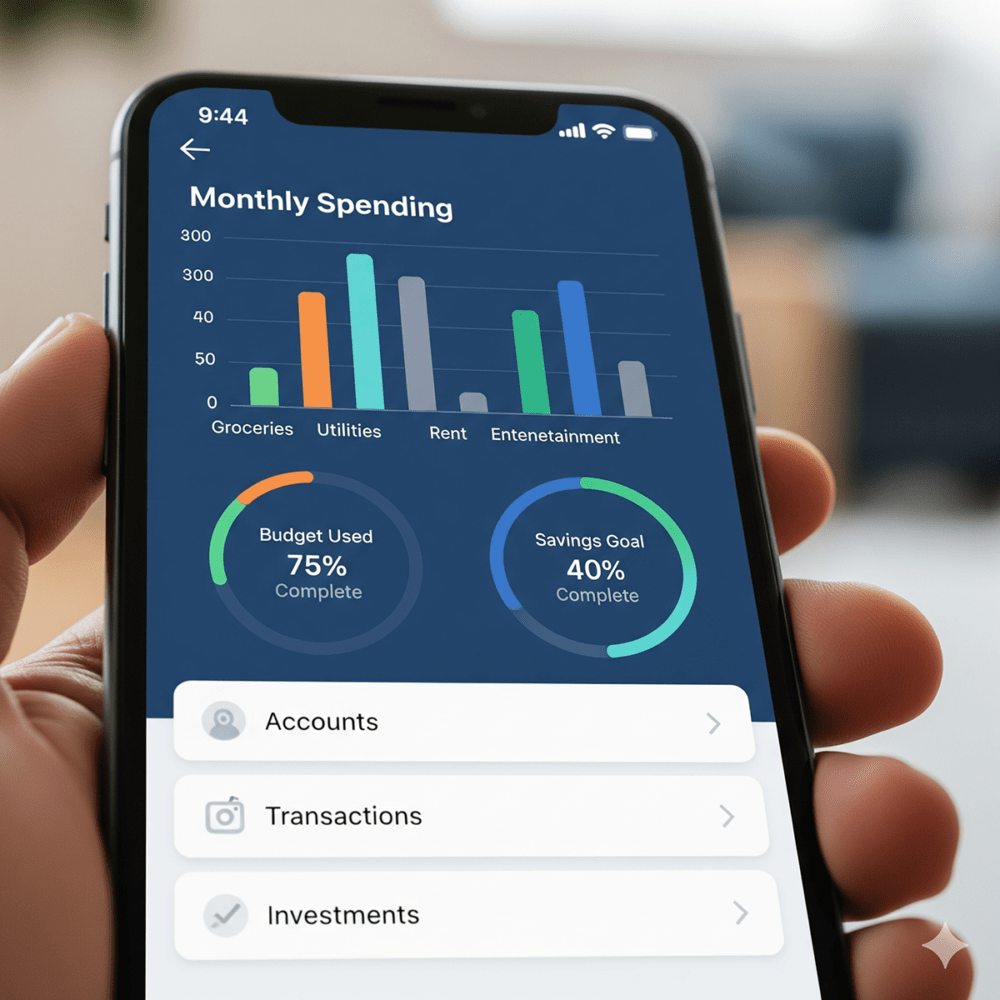

The year 2025 marks a turning point in personal finance. We’re moving beyond simple budgeting and saving to an era where AI-driven advice, decentralized finance (DeFi), and hyper-personalized platforms are putting true financial power directly in our hands. With millennials and Gen Z increasingly choosing digital-first solutions over traditional banks (with approximately 80% of millennials preferring digital banking over in-person branch visits), this new wave of fintech apps is reshaping how we think about money itself.

These platforms use blockchain for secure transactions, real-time analytics for instant insights, and AI that automates everything from budgeting to investing, making financial management feel less like a chore and more like having a smart assistant that actually understands your goals.

Revolut: Your Financial Super App

Revolut has grown into a global financial hub, offering:

- Multi-currency accounts with instant exchange

- Commission-free stock and crypto trading

- AI-powered budgeting and personalized analytics

- Secure crypto wallets leveraging blockchain tech

- Travel perks and integrated savings vaults

🚀 Competitive Edge: Compared to Wise, which excels in low-cost international transfers (e.g., 0.4% fees vs. Revolut’s 0.6% for some currencies), Revolut’s strength lies in its all-in-one approach, including crypto trading and AI-driven spending insights.

⚠️ Note: Some features require a premium subscription, and availability varies by region.

👍 Best for: Professionals managing international finances or seeking a versatile all-in-one platform.

YNAB: Zero-Based Budgeting Mastery

YNAB is more than a budgeting app, it’s a money management philosophy. Features include:

- Zero-based budgeting that assigns every dollar a job

- Real-time syncing across devices

- Goal tracking and progress visualization

🚀 Competitive Edge: Unlike Mint’s now-defunct broad approach, YNAB’s structured methodology suits disciplined savers. It outperforms free apps like Goodbudget in syncing and analytics but has a steeper learning curve.

⚠️ Note: YNAB has a learning curve, and its subscription fee may deter casual users. However, its value lies in building disciplined, long-term money habits.

👍 Best for: Budgeting enthusiasts who want structure and accountability.

Public: Investing with Community and Transparency

Public is a commission-free investing platform with a social twist. It offers:

- Stock, ETF, and crypto trading without commissions

- ESG-focused investment options

- The ability to follow expert investors and learn from their strategies

- Access to alternative assets like treasuries and collectibles

🚀 Competitive Edge: Public’s social features outshine Robinhood’s gamified interface, emphasizing community learning over trading hype. Its ESG focus appeals to ethical investors, though it lacks Robinhood’s advanced charting tools.

⚠️ Note: Advanced traders may find fewer tools compared to full-service brokers.

👍 Best for: Beginners and socially conscious investors who value education and community.

Monarch Money: The Mint Alternative

With Mint phased out in 2024, Monarch Money has become a leading choice for modern budgeting. It provides:

- Collaborative tools for couples and families

- Sleek dashboards and long-term planning features

- Automatic syncing with banks and credit cards

- Flexible goal-setting and forecasting

🚀 Competitive Edge: Monarch’s collaborative features surpass PocketGuard’s solo-focused budgeting, making it ideal for shared finances. Its forecasting tools are more robust than YNAB’s for long-term planning.

⚠️ Note: Monarch requires a paid subscription, but a free trial is available for new users.

👍 Best for: Families and individuals seeking a modern, collaborative budgeting solution.

Acorns: Investing Made Effortless

Acorns pioneered micro-investing and continues to grow. In 2025, it offers:

- Automatic round-up investing for spare change

- ESG-focused portfolios for socially conscious investors

- Retirement accounts (IRA, SEP) and custodial accounts

- Educational content for financial literacy

🚀 Competitive Edge: Acorns’ simplicity beats Wealthfront for beginners, as its round-up feature requires no active input. However, Wealthfront’s tax-loss harvesting suits larger portfolios.

⚠️ Note: Management fees can feel high for very small balances, though the impact lessens as investments grow.

👍 Best for: Beginners who want a simple, automated way to start investing.

Monzo: Digital Banking Reimagined

Monzo is one of Europe’s most popular neobanks, expanding globally. It delivers:

- Fee-free accounts with real-time transaction alerts

- Built-in budgeting and savings “pots”

- Transparent overdraft and lending features

- A mobile-first experience with instant notifications

🚀 Competitive Edge: Monzo’s user-friendly interface and budgeting tools outpace Chime’s basic banking features, though Chime offers no-fee overdrafts in the U.S.

⚠️ Note: Some services outside the UK/EU remain limited, but Monzo is expanding into new markets.

👍 Best for: Digital-first users seeking a transparent, user-friendly banking alternative.

Wealthfront: Automated Wealth Building

Wealthfront remains a top robo-advisor, now expanded into crypto and cash management. It offers:

- AI-driven, automated investment portfolios

- Tax-loss harvesting and smart portfolio rebalancing

- Diversified crypto portfolios alongside traditional assets

- High-interest cash accounts with FDIC insurance

🚀 Competitive Edge: Wealthfront’s tax optimization outperforms Betterment for high-net-worth users, but Betterment offers more hands-on advisory options.

⚠️ Note: Wealthfront offers less customization than DIY platforms, but this trade-off appeals to investors who prefer a hands-off approach. Competitors like Betterment offer similar services.

👍 Best for: Long-term planners who want low-cost, automated investing with minimal effort.

Quick Comparison

| App | Key Features | Best For | Potential Drawback |

|---|---|---|---|

| Revolut | Multi-currency, trading, AI budgeting, crypto | Global professionals | Premium plans, regional limits |

| YNAB | Zero-based budgeting, goal tracking | Budgeting enthusiasts | Learning curve, subscription cost |

| Public | Social investing, ESG options, alt assets | Beginner/social investors | Limited advanced tools |

| Monarch | Collaborative budgeting, goal planning | Families, modern budgeters | Paid subscription (with trial) |

| Acorns | Micro-investing, ESG portfolios, retirement | New investors | Fees high for small balances |

| Monzo | Fee-free digital banking, savings pots | Global digital users | Limited outside UK/EU |

| Wealthfront | Automated investing, tax optimization, crypto | Long-term planners | Limited customization |

Final Thoughts

In 2025, fintech is moving beyond simple convenience, giving users unprecedented control over their financial lives. From micro-investing with Acorns to collaborative budgeting with Monarch Money, these apps offer tailored solutions for every stage of your financial journey.

For cost-conscious users, free alternatives like Goodbudget offer basic budgeting without subscriptions (limited envelopes, 1 account, community support), while Chime provides no-fee banking in the U.S. For a balanced setup, try pairing Monzo’s free banking with Acorns for micro-investing, or combine Goodbudget’s free tools with Wealthfront for hands-off wealth building. Experiment with free trials or low-cost options to find what fits your financial journey, and stay adaptable as fintech evolves rapidly.

⸻

⚠️ Disclaimer: This article is for informational purposes only and should not be considered financial advice. Always consult a licensed professional before making major financial decisions.