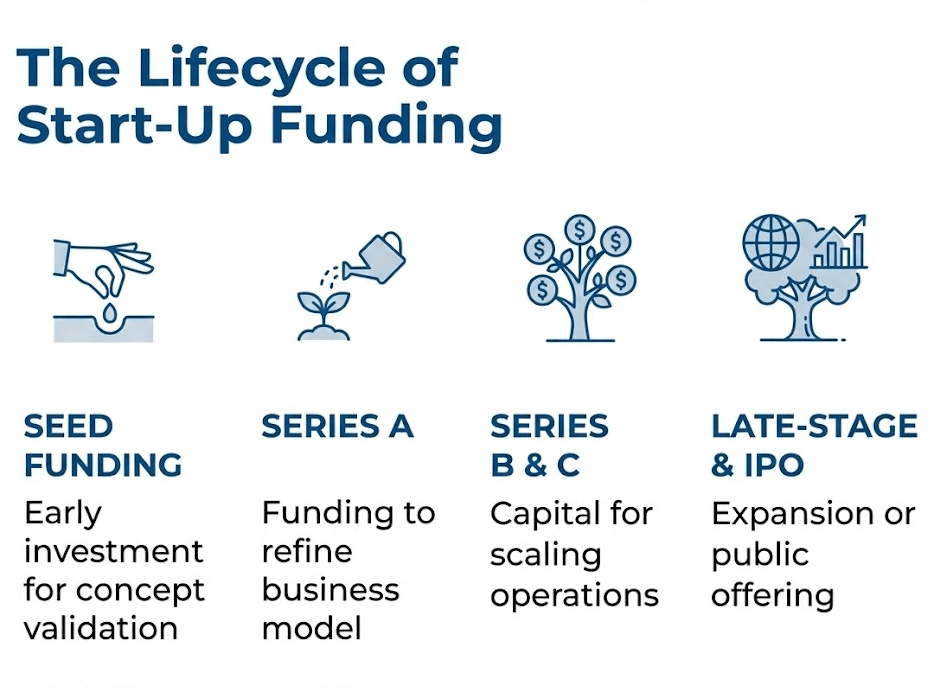

Start-ups live and breathe on momentum. The energy of an idea, the enthusiasm of a founding team, and the early vote of confidence from investors can push a young business into the market with surprising speed. Yet, once the first wave of funding dries up, many founders find themselves facing a much tougher stage: the funding gap. This is the chasm between early-stage capital and the larger, growth-oriented investments that fuel scale. It’s a hurdle that has tripped up countless promising ventures, not because the idea wasn’t good, but because moving from seed success to real expansion demands a different playbook.

Why the Funding Gap Exists

The gap is real because early funding tends to be about vision. Angel investors and seed funds often back an entrepreneur’s story, their energy, and a sketch of potential. But when the company needs millions to expand operations, the story has to change. Investors at this stage want proof, not just promise. They’re looking for traction: consistent revenue, a solid business model, customer retention, and scalable systems. Without these, many start-ups stall out, no matter how innovative the product or service may be.

Adding to the difficulty, institutional investors often grow cautious when risk is perceived as high. They’ve seen plenty of early ventures flame out, and they want evidence that this one won’t join the pile. That investor hesitation creates a funding drought, leaving founders scrambling to find creative ways to keep momentum alive.

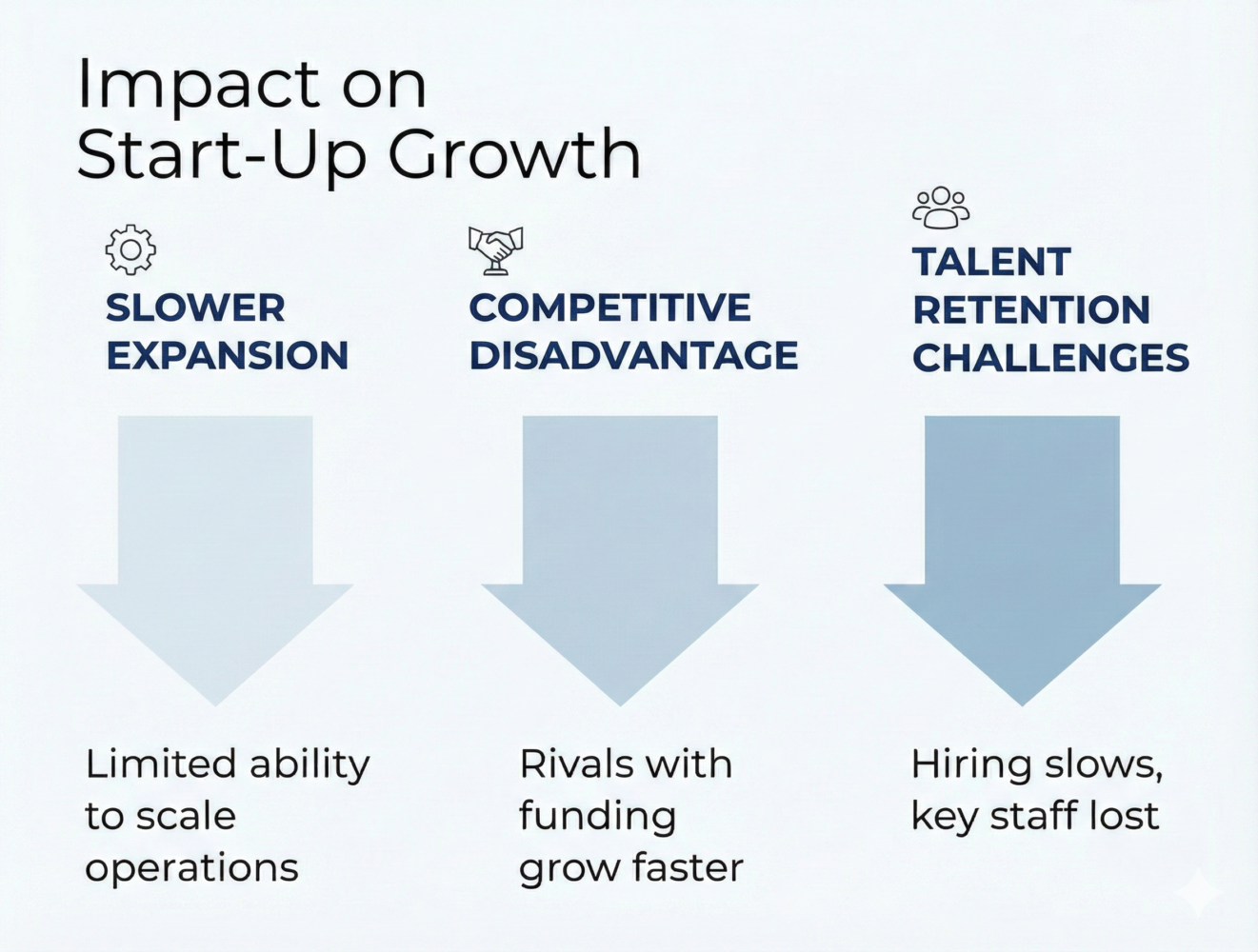

Investor Risk Aversion and Its Ripple Effects

Risk aversion is a natural part of the capital world, but its impact on scaling companies is massive. A start-up that shows early promise may still face skepticism if its industry is volatile, its margins are thin, or its competition is fierce. Even clean tech investing, a sector rich with promise and long-term value, often struggles here. While governments and institutions talk about the future of renewable energy, private investors still hesitate to commit unless the business model looks airtight. The result is a double bind: industries we need for the future struggle for capital in the present, and founders must prove viability faster than ever.

The Proof Problem: Building a Business Model That Scales

The second major cause of the funding gap is the demand for proof. Scaling doesn’t just mean “more customers.” It means more systems, more logistics, more staff, and often more regulatory compliance. Investors want to know that the engine of the business can handle higher speeds without breaking down. If customer retention rates are shaky or margins are slim, scaling looks like a gamble.

Alternative Paths to Keep Growth Alive

Because traditional routes can dry up, founders have to consider alternative capital strategies. Strategic partnerships are one way forward. Pairing with a larger player in the industry can open doors not just to funding, but also to supply chains, customer bases, and technical expertise. Debt financing, while riskier for a young company, can sometimes serve as a bridge when equity investors hesitate. Crowdfunding, though less glamorous, has proven to be a powerful way to both raise money and validate demand.

Government grants and programs also play a role, particularly in areas tied to innovation or public interest. In fields such as healthcare, sustainability, and clean tech, public funds may be available to reduce the burden on founders trying to prove viability. While grants rarely cover everything, they can keep operations alive long enough to attract bigger capital.

Customer Retention: The Overlooked Growth Engine

One of the smartest ways to address the funding gap is also one of the least flashy: keeping the customers you already have. Retention isn’t just cheaper than acquisition. It’s proof that your product delivers real value. A start-up with loyal, recurring customers doesn’t need to rely solely on investor confidence; it has the numbers to show that the model works.

Enterprise recurring billing models, for example, are a signal to investors that revenue is stable and predictable. That’s gold in the world of finance. Start-ups that build strong retention strategies — through better service, consistent product quality, or innovative add-ons — often stand out in a crowded funding environment.

The Psychological Weight on Founders

The funding gap isn’t just financial. It’s personal. Founders who’ve already poured years of energy into their company often face a crushing sense of frustration when the money dries up just as things are starting to click. They may feel as though the system is stacked against them, rewarding flashy pitches but punishing the slow, steady builders. This psychological weight can lead to burnout, hasty decisions, or premature exits.

Long-Term Thinking in a Short-Term World

Ultimately, bridging the funding gap requires balancing immediate needs with long-term vision. Investors want to see numbers that prove stability, but they also want to know the company has room to grow. That means founders have to learn to tell two stories at once: the pragmatic story of today’s revenue and retention and the visionary story of tomorrow’s expansion.

Those who succeed often frame their growth not as a leap into the unknown, but as a series of carefully planned steps. This reassures investors that the path ahead is less about risk and more about strategy.

Building a Resilient Capital Strategy

Start-ups that make it across the gap usually share some common traits. They diversify their funding sources, so that no single investor holds the keys to survival. They build strong relationships with customers and treat retention as a non-negotiable. They’re open to nontraditional funding streams and ready to pivot if one door closes. And, perhaps most importantly, they learn to manage growth carefully, scaling in a way that matches their resources rather than racing ahead blindly.

The funding gap is unlikely to disappear. It’s baked into the structure of how capital flows. But by recognizing it early and planning for it, founders can avoid the trap of being caught off guard. The businesses that thrive are often the ones that prepare not just for the excitement of launch, but for the grind of scale.

Scaling a start-up will never be a straight path, and the funding gap is one of the toughest stretches of road. But it isn’t a dead end. Founders who anticipate the challenge, strengthen their business model, and remain open to alternative capital strategies stand a far better chance of pulling through. Whether through partnerships, government support, or a relentless focus on customer retention, it’s possible to bridge the chasm. The companies that do will not only survive, but also will build the kind of resilience that attracts long-term investors and sets the stage for lasting growth.