Are you looking for the best trading platforms UK 2025? We’ve conducted an in-depth review of leading UK brokers and banking platforms, assessing them on execution quality, fee structures, market coverage, platform stability, and regulatory safeguards. Our analysis draws on verified data, platform testing, and financial disclosures to present only those services that meet high standards for both active traders and long-term investors.

We designed this guide to offer you a clear, evidence-based comparison so you can select a platform that aligns with your investment goals and trading style.

Best trading platforms in UK – 2025

Based on our research, these are the top 10 platforms that offer a strong mix of market access, pricing transparency, reliability, and user experience for UK investors. Each excels in specific areas, but XTB stands out as the overall best choice.

- XTB – Best overall trading platform for UK investors

- Spreadex – Best for combining financial and sports betting

- Pepperstone – Best for advanced trading tools and execution speed

- Fineco Bank – Best for global market coverage with ISA option

- DEGIRO – Best for ultra-low-cost global investing

- Santander Invest – Best for integrated banking and low entry point

- Barclays Smart Investor – Best for breadth of investment choice from a UK bank

- Lloyds Bank Share Dealing – Best for simple, predictable fees

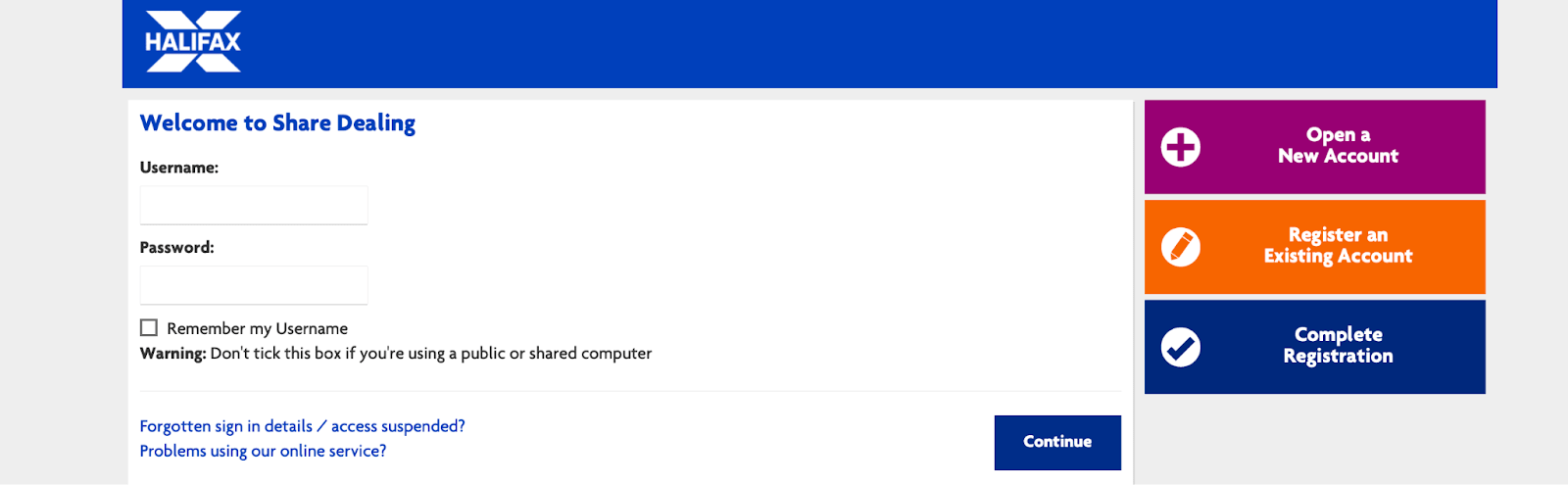

- Halifax Share Dealing – Best for flat annual fees on large portfolios

- HSBC InvestDirect – Best for UK–US market access with bank integration

What’s our evaluation process?

Our team of experts tested over 20 UK trading platforms, assessing each on measurable performance and investor-focused criteria. We based our rankings on:

- Execution quality

- Fee structure

- Market coverage

- Platform usability

- Regulatory safeguards

Review of the top trading platforms for UK investors

1. XTB

XTB is a leading global trading platform founded in 2004, with offices in both London and Warsaw operating in more than 13 countries serving 1.7 million clients worldwide. The brokerage offers access to over 10,800 financial instruments via its proprietary platform, xStation 5. The platform is available on desktop, web, and mobile, designed to combine an intuitive interface with advanced analytical capabilities for retail and professional traders alike.

However, XTB UK does not provide cryptocurrency trading services due to compliance with FCA rules. For all trading activities on this platform, investors should be aware that the value of investments can both rise and fall, and the capital is at risk.

Fees:

- 0% commission on stocks and ETFs on equivalent up to €100,000 per month; 0.2% thereafter (minimum £10)

- 0% commission on CFDs

- Currency conversion fee: 0.5% per trade

- Inactivity fee: £10 per month after 12 months without trading activity

Key Features:

- Access to 10,800 tradable instruments including stocks, ETFs, indices, commodities, and forex

- ETF auto-invest options (Investment Plans) and fractional share trading

- Flexible Stocks & Shares ISA

- Earn interest on uninvested funds, 4.25% GBP, 4.2% USD, 2.3% EUR

- Advanced charting tools with fast execution speeds

- Integrated market news, research, and push notifications

- Mobile, web, and desktop access

- Deposits and withdrawals are free

- Educational resources (video tutorials, live webinars, market analysis, economic calendar)

- Negative balance protection

- No minimum deposit requirement

- 24/5 customer support

Why we chose it:

XTB provides extensive market coverage, allowing traders to access a wide range of financial instruments including forex, indices, commodities, stocks, and a Flexible Stocks & Shares ISA. Their trading platform is thoughtfully designed with user-friendly features, advanced charting tools, and robust execution capabilities to support both beginner and experienced traders. Additionally, XTB offers competitive fee structures, including tight spreads and low commissions, ensuring cost-effective trading for its clients.

Note that CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

2. Spreadex

Spreadex is a privately owned UK company founded in 1999 and headquartered in St Albans, Hertfordshire. It operates a proprietary online platform that supports financial spread betting, CFDs, and options trading across more than 1,000 markets, including forex, indices, equities, commodities, bonds, and cryptocurrencies. The same account also offers access to sports betting and fixed-odds markets, making it a unique proposition in the UK. Spreadex holds full authorization for financial services and a licence for betting activities, maintaining a strong reputation through industry awards for customer service and mobile trading performance.

Fees:

- Spread betting: No commission; costs in spread (EUR/USD from 0.6 pips)

- CFDs: Fees in spread (S&P 500 average 0.4 points; Europe 50 average 1.8 points in peak hours)

- Forex: Spreads from 0.6 pips on major pairs

- Account opening: Free

- Withdrawals: Free

- Inactivity fee: None

Key Features:

- 1,000+ global markets including FX, indices, equities, commodities, bonds, and crypto

- Tax-free spread betting for eligible UK residents

- Advanced charting with TradingView integration

- Multiple order types including trailing stops and force opens

- Price alerts via SMS, email, or push notifications

- Same-day withdrawal options

- Negative balance protection for retail accounts

Why we chose it:

Spreadex’s capability to combine financial and sports betting on a single, award-winning platform.

3. Pepperstone

Pepperstone is a brokerage established in 2010 and headquartered in Melbourne, with additional offices in London, Düsseldorf, Limassol, Nairobi, Nassau, and Dubai. The company provides access to over 1,350 CFDs covering forex, indices, equities, commodities, ETFs, and cryptocurrencies, with a focus on execution speed and platform flexibility. Clients can trade using MetaTrader 4, MetaTrader 5, cTrader, TradingView, or Pepperstone’s proprietary web platform, with support for algorithmic trading, copy trading, and advanced risk management tools. Its infrastructure is integrated with deep liquidity pools, enabling low-latency execution for both retail and professional traders.

Fees:

- Standard account: Spreads from 0.6 pips, no commission

- Razor account: Spreads from 0.1 pips + $6–$7 commission per lot

- Equity CFDs: 0.07%–0.20% (min £14 per UK equity trade)

- US share CFDs: $0.02 per share (min $1)

- 1% currency conversion fee

- No inactivity or withdrawal fees

- Free account opening, $0 minimum deposit

Key Features:

- Multi-platform access: MT4, MT5, cTrader, TradingView, proprietary web platform

- Smart Trader Tools, Autochartist, Capitalise AI for code-free automation

- VPS hosting for algorithmic strategies

- 24-hour US share CFD trading on 100+ stocks

- Copy and social trading integrations

- Negative balance protection

- 1,350+ CFDs across major and niche markets

Why we chose it:

Pepperstone excels in execution speed, platform variety, and advanced trading tools.

4. Fineco Bank

Fineco Bank, established in 1999 in Milan, is a publicly listed financial institution on the Borsa Italiana and a constituent of the FTSE MIB index. It operates in the UK market as both a bank and broker, offering integrated multi-currency accounts and direct access to 26 global exchanges with over 20,000 tradable instruments. The bank’s platforms (FinecoX for web, PowerDesk for desktop, and a dedicated mobile app) deliver professional-grade charting, real-time market data, and customizable workspaces. UK clients can also benefit from ISA accounts, enabling tax-efficient investing within the annual allowance.

Fees:

- Account opening/maintenance: Free

- Minimum deposit: £0

- UK stocks/ETFs: Capped at £2.95/month per instrument (ISA)

- US stocks: £3.95 per trade

- Euronext stocks: €9 per trade

- CFDs: Commission-free (spread and overnight rates apply)

- Futures: $0.70 per contract

- Currency conversion: Variable spread, reduced with higher balances

- No inactivity fees

Key Features:

- Multi-platform access: FinecoX, PowerDesk, Web, and mobile app

- Global market access: 26 exchanges, 20,000+ assets

- Integrated multi-currency banking and brokerage

- ISA accounts for UK tax efficiency

- Advanced charting with 90+ technical indicators

- Real-time news and market data

- High-level account security and regulatory oversight

Why we chose it:

Fineco Bank’s broad market coverage and seamless banking integration make it a solid pick among the top trading platforms in 2025.

5. DEGIRO

DEGIRO, founded in 2008 in Amsterdam and owned by the Frankfurt-listed flatex AG since 2020, operates as a low-cost online brokerage with services available to UK investors. Its web-based and mobile platforms are designed for simplicity and efficient trade execution, providing access to more than 50 global exchanges in 30 countries. The platform supports a wide range of assets, including stocks, ETFs, bonds, options, futures, and warrants, with a fee structure that is among the lowest in Europe. While advanced charting is limited, DEGIRO focuses on cost transparency, global diversification opportunities, and straightforward order placement for retail investors.

Fees:

- UK/EU/US stocks: ~£1.75 per order (€1 + €1 handling fee)

- Core ETFs: First trade per month free, €1 service fee thereafter

- Other ETFs: ~£2.75 per order (€2 + €1 service fee)

- Options/futures: €0.75 per contract

- Currency conversion: 0.25% per trade

- Connectivity fee: €2.50/year per non-home exchange

- No account, inactivity, or custody fees

Key Features:

- Web and mobile platforms with intuitive design

- Access to 50+ exchanges in 30 countries

- Wide product range: stocks, ETFs, bonds, options, futures, warrants

- Multi-currency accounts

- Real-time quotes and integrated market news

- Basic research tools and fundamental data

- Secure login with two-factor authentication

- No minimum deposit requirement

Why we chose it:

DEGIRO has ultra-low fees and broad global market access.

6. Santander Invest

Santander Invest operates through the Santander Investment Hub, a digital platform offering UK investors the ability to manage investments alongside everyday banking. The platform provides access to over 850 funds, including ready-made, risk-profiled portfolios managed by Santander Asset Management, as well as the option to construct a custom portfolio. Accounts include Stocks & Shares ISAs, GIAs, and SIPPs, all accessible via web and mobile apps with real-time analytics and fund performance tracking. Additional services include the Digital Investment Adviser for low-cost guidance and full portfolio consolidation tools.

Fees:

- Platform fee: 0.35% up to £50,000; 0.20% from £50,000–£500,000; 0.10% above £500,000

- Fund trading: Free (no dealing charges)

- Digital advice: £20; personal advice: from £500

- Fund OCF: From 0.1% (index funds) to 1.49%+ (active funds)

- Withdrawals/deposits: Free

- Minimum investment: £20/month or £100 lump sum per fund

Key Features:

- 850+ UK and global funds

- Ready-made portfolios and sustainable options

- ISA, GIA, SIPP accounts

- Integrated with Santander banking

- Mobile and web access with real-time analytics

- Interest on cash holdings

- Portfolio transfer and consolidation support

- FCA-regulated with segregated accounts

Why we chose it:

Santander Invest is known for low entry point, strong banking integration, and broad fund choice.

7. Barclays Smart Investor

Barclays Smart Investor is an online investment service operated by Barclays Bank UK PLC, offering UK investors access to more than 8,000 assets, including shares, ETFs, funds, bonds, and investment trusts. The platform supports both self-directed investing and ready-made, risk-profiled portfolios with automatic rebalancing. It integrates seamlessly with Barclays’ online and mobile banking, allowing customers to manage investments and banking from a single login. Research tools, market news, and analyst updates are built into the platform to support informed decision-making.

Fees:

- Platform fee: 0.25% on assets up to £200,000; 0.05% above £200,000

- Fund trading: Free

- Share/ETF/investment trust trades: £6 per transaction

- Regular investing: Free for monthly plans

- FX fee: Tiered from 1% down to 0.1% for large trades

- SIPP admin fee: £150/year (£120/year in drawdown)

- No inactivity fee; free account opening

Key Features:

- 8,000+ investment choices, including global shares

- ISA, GIA, and SIPP accounts

- Ready-made portfolios with rebalancing

- Integrated banking and investment management

- Research tools and educational content

- Free regular investing

- FSCS-protected

- Mobile and web platform access

Why we chose it:

Barclays Smart Investor offers deep investment range, transparent pricing, and banking integration.

8. Lloyds Bank Share Dealing

Lloyds Bank Share Dealing is an online investment service operated under Lloyds Banking Group, providing UK investors with straightforward access to UK, US, and select European shares, ETFs, funds, and bonds. The platform is web-based and integrates with Lloyds’ online banking for existing customers, allowing consolidated account management. Regular monthly investing is available free of charge, and one-off trades are processed through the Halifax Share Dealing infrastructure for efficient settlement. While it offers essential research and historic pricing tools, the service focuses on simplicity over advanced trading features.

Fees:

- Account admin fee: £20 every 6 months (ISA & Share Dealing accounts)

- Share/ETF/bond trades: £11 per trade (£8 for frequent traders)

- Fund trading: £1.50 per trade

- International shares: £0 commission, 1% FX fee

- Dividend reinvestment: 2% (max £10 per reinvestment)

- SIPP admin fee: 0.25% portfolio charge, capped at £16.50/month

- No inactivity or withdrawal fees

Key Features:

- ISA, GIA, and SIPP accounts

- UK, US, and EU market access

- Free regular monthly investing

- Integrated banking for Lloyds customers

- Flat-rate dealing fees

- Simple online dashboard

- Secure and FCA-regulated via Halifax Share Dealing Ltd.

- No minimum account balance

Why we chose it:

Lloyds Bank Share Dealing combines predictable fees, banking integration, and ease of use.

9. Halifax Share Dealing

Halifax Share Dealing is an online investment service operated by Halifax Share Dealing Limited, a subsidiary of Lloyds Banking Group. Established in 1996, the platform provides UK investors with access to domestic and international equities, ETFs, funds, bonds, and gilts through a straightforward web-based interface. It integrates with Halifax’s online and mobile banking for existing customers, allowing banking and investment accounts to be managed from the same login. The service is designed for self-directed investors seeking transparent pricing, tax-efficient accounts, and bank-backed stability rather than advanced trading tools.

Fees:

- Account admin fee: £36/year (waived for ages 18–25)

- UK share/fund trades: £9.50 per trade

- International share trades: £0 commission, 1.25% FX fee

- SIPP admin fee: 0.25% per year, capped at £198

- Regular investing: Free (£20+/month)

- Dividend reinvestment: 2% (max £10 per event)

- No inactivity or withdrawal fees

Key Features:

- Access to UK, US, and other global markets

- ISA, GIA, SIPP, Junior ISA, Lifetime ISA

- Free regular investing from £20/month

- Flat annual admin fee advantageous for large portfolios

- Secure FCA-regulated service with FSCS protection

- Basic research tools and portfolio tracking

- No minimum deposit requirement

Why we chose it:

Halifax Share Dealing provides a flat-fee structure and broad account options that make it a cost-effective and stable choice.

10. HSBC InvestDirect

HSBC InvestDirect is a self-directed online share dealing platform offered by HSBC UK Bank plc, providing UK investors with access to domestic equities, ETFs, gilts, and investment trusts. Through its InvestDirect Plus account, clients can also trade US-listed equities, making it suitable for those seeking both UK and transatlantic market exposure. The platform integrates with HSBC’s online and mobile banking, enabling seamless funding, withdrawals, and consolidated account oversight.

Fees:

- Account fee: £10.50/quarter (£42/year)

- UK share/ETF/trust/gilt trades: £10.50 per trade

- Frequent trader rate: £7.95 per trade after 9th in a quarter (Plus account)

- US trades: $29.95 (Plus account)

- Gilts: £39.95 per trade

- Euro trades: €29.95 per trade

- No inactivity or withdrawal fees

Key Features:

- UK and US share dealing (via InvestDirect Plus)

- ISA and GIA account types

- Linked HSBC current account for instant transfers

- Real-time trading, market news, and price alerts

- No minimum investment requirement

- FCA-regulated, FSCS-protected

- Separate cash account option for quick deployment of funds

Why we chose it:

HSBC InvestDirect offers a strong banking integration and dual UK–US market access.

Conclusion

The UK market in 2025 offers a diverse range of trading platforms, each tailored to different investor needs, from cost efficiency and global market access to banking integration and advanced trading tools.

Based on our research, we’ve found that XTB stands out as the top choice for its balance of low fees, strong platform performance, and broad product coverage. Take your time comparing features, fees, and account options to select the platform that best supports your strategy while ensuring a secure and efficient trading experience.

FAQ

1. What is the best trading platform in the UK for 2025?

XTB ranks highest for UK investors in 2025 due to its fast execution, 0% commission on stocks and ETFs on equivalent up to €100,000 monthly turnover, and access to over 10,800 instruments. Its proprietary xStation 5 platform combines advanced charting, risk management tools, and real-time market data in a user-friendly design. XTB also offers fractional shares, ETF auto-invest, a Flexible Stocks & Shares ISA and a demo account for practice.

2. How do UK trading platform fees work?

UK trading platforms typically charge a combination of commission fees per trade, platform or account maintenance fees, and currency conversion costs for foreign assets. Some platforms offer commission-free trades on specific products within limits. Fee structures vary by asset type and trading volume, making comparison essential for cost efficiency.

3. Which trading platforms in the UK offer the widest range of assets?

Platforms such as Fineco Bank, DEGIRO, and Pepperstone offer broad market coverage across global equities, ETFs, bonds, funds, commodities, indices, forex, and in some cases cryptocurrencies. Fineco covers 26 global exchanges, while DEGIRO connects to 50+ markets in 30 countries. Asset diversity allows investors to diversify portfolios across regions and sectors.

4. Are UK trading platforms regulated?

Yes. UK trading platforms that handle client money and investments must be authorised and regulated by the Financial Conduct Authority (FCA). FCA regulation ensures client funds are held in segregated accounts and provides access to the Financial Services Compensation Scheme (FSCS) for eligible investments, typically up to £85,000.

5. Can I open an ISA through a trading platform?

Many UK platforms, including XTB, Fineco Bank, Barclays Smart Investor, and Santander Invest, offer Stocks & Shares ISAs. These accounts allow investors to buy shares, ETFs, and funds while shielding returns from UK capital gains and dividend taxes up to the annual ISA allowance. Availability and product range vary by provider.