Planning a dream wedding can be thrilling yet daunting, especially when it comes to financing. The average wedding in 2024 could cost $34,000. Prequalifying for loans is often the initial step for couples in funding their perfect celebration while managing their finances.

Understanding Loan Prequalification for Your Dream Wedding

To prequalify for a personal loan, you need to contact a lender before submitting your application to receive an estimate of the potential loan amount and the terms for which you may be eligible.

This helps determine your potential eligibility and repayment ability based on your financial profile. This happens before completing credit checks and submitting documentation.

The average wedding expenditure exceeds $28,000 for the ceremony and reception. Prequalification prevents committing to loan amounts that might become burdensome later. It also helps compare interest rates and terms across lenders to choose what aligns best with your wedding budget.

Types of Loans That Could Help Finance a Wedding

There are a few options couples could consider when exploring wedding loans:

Personal Loans

It has competitive rates of around 8.73% APR for 24-month terms. You can borrow based on your credit profile and income. They offer fixed, predictable repayment schedules to plan without needing collateral.

Home Equity Loans

For homeowners with enough equity, credit lines backed by your property may offer attractive rates. You can use your home as collateral. However, strict eligibility criteria, closing costs, and the risk of foreclosure must be carefully evaluated before pursuing this option.

Alternatives like credit cards or family loans could also be workable, depending on a couple’s specific situation.

Evaluating Your Financial Health

Lenders assess key criteria to estimate what wedding loan terms couples may qualify for during prequalification:

Credit History

Good credit scores (680 and above) reflect responsible financial behavior. They could qualify borrowers for preferable loan rates and terms. If needed, couples can aim to build credit via credit builder loans before applying.

Debt-to-Income (DTI) Ratio

Your DTI ratio helps lenders test your capacity to manage extra wedding loan debt. If your DTI exceeds 43%, reducing debts beforehand by paying down balances can improve your DTI.

Income Stability

Steady, verifiable income for the past two years assures lenders of your potential to repay wedding loans. Bonuses and freelance income often must be further proven through extra bank statements.

Checking these parameters before applying for prequalification sets realistic expectations for obtaining wedding financing at affordable rates. This ensures you have a realistic understanding of what to expect.

The Loan Prequalification Process: Key Steps

The pre-qualification process involves submitting basic personal and financial information. Lenders use this to provide a preliminary eligibility assessment. Required details often include:

- Full legal name, contact details, and social security number so lenders can access your credit history

- Income statements like tax returns, pay stubs, or bank statements from the past two years to analyze repayment ability

- A credit check authorization form permitting a soft inquiry that should not impact credit scores

While pre-qualification provides an estimate, it does not guarantee final approval. But, it offers guidance by confirming if applicants fit the profile of before-approved borrowers. So, applying with many lenders improves visibility into suitable wedding loan options.

Comparing Loan Offers: What to Examine

With the average wedding costing over $28,000, couples’ required loan amounts can be large. Scrutinizing every offer and comparing terms is crucial:

- Interest Rates and APR — The APR displays the true annual cost of borrowing when accounting for all fees. Opt for the lowest APR.

- Loan Term and Repayment Plan – Longer terms, like 60 months, reduce monthly dues but increase the total interest paid over the full duration. Choose the shortest, most affordable term you can manage.

- Fees and Penalties: Avoid loans with expensive origination charges or repayment penalties to prevent unmanageable costs. Read all the fine print before signing.

Assess all options based on your budget and expected monthly cash flows before finalizing a wedding lender.

Budgeting with Your Wedding Loan

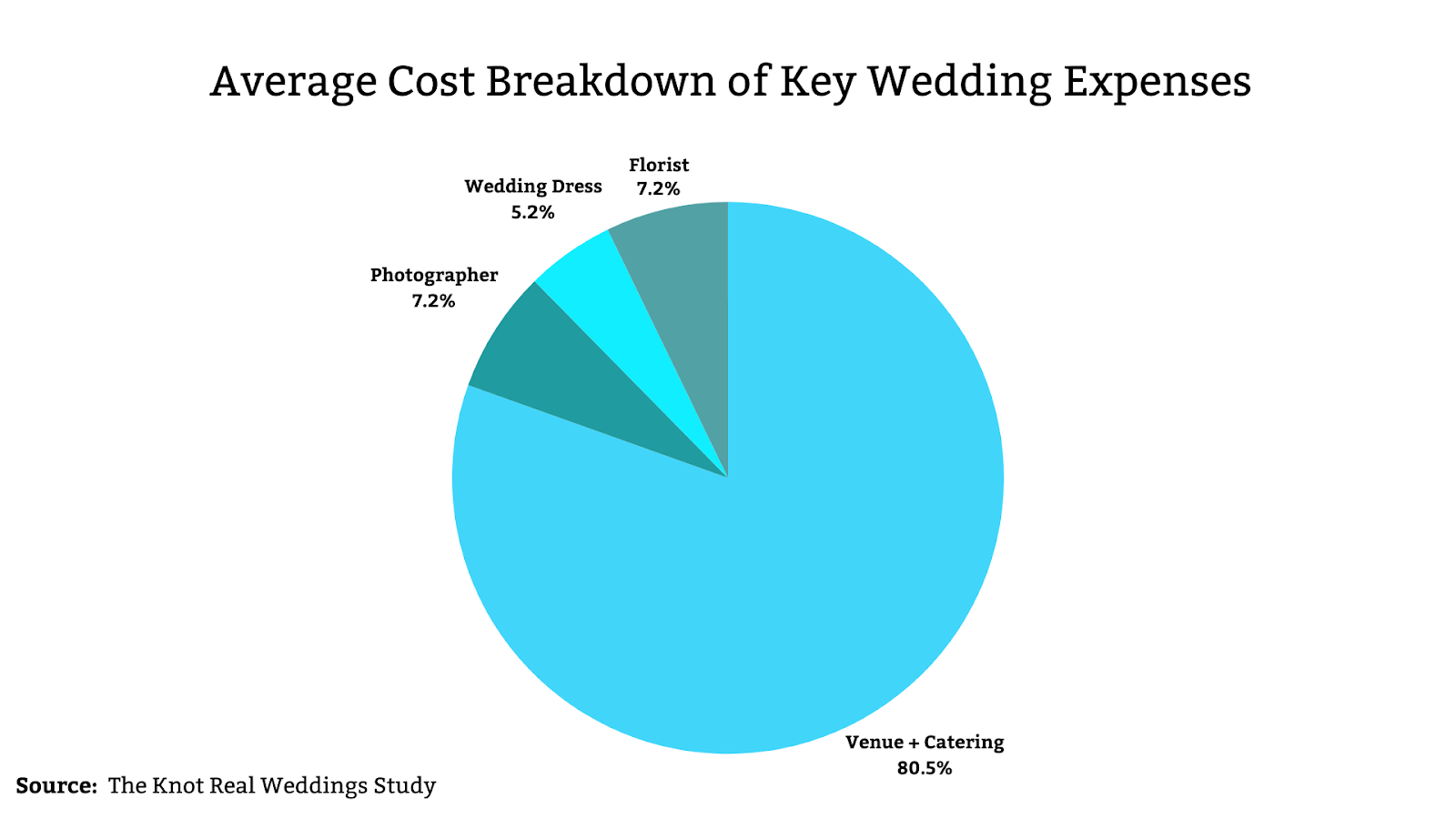

Major wedding elements like venue, food, and photography average between $2,500 and $10,700. Disciplined budgeting prevents overspending your total available credit.

Prioritizing spending on essentials can help divide loans:

- Venue, catering, and decor account for almost 50% of the typical wedding budget

- Photographer and videographer

- Bridal attire

- Entertainment and music

Repayments are easier to handle if you plan for them by contributing money to a dedicated account each month. This helps you avoid struggling later.

Common Mistakes to Avoid During Wedding Loan Prequalification

Amidst the euphoria of wedding planning stages and available financing, it’s easy to overestimate your ability to repay, leading to problems later. Watch for pitfalls like:

- Assuming higher future earnings without firm commitments

- Using loans for non-essential expenses like lavish honeymoons

- Overlooking unfavorable fine-print repayment terms that could constrain cash flows

Too many loan applications while rate-shopping can also impact your credit score. Limit hard credit check inquiries and enroll in monitoring to spot any shifts.

FAQs on Wedding Loan Prequalification

What key factors determine my eligibility for wedding loans?

Lenders test your credit history, debt levels, and income stability to estimate potential wedding loan terms you may qualify for during pre-approval. Strengthening these well in advance helps.

How does getting prequalified impact my credit score?

Initial soft check credit inquiries only access your reports to assess possible eligibility. They should not affect scores. But limit hard credit check applications during final selection to avoid temporary score drops.

What if I don’t have an extensive credit history yet? Can I still qualify?

Yes, some lenders offer options for limited credit histories. But, they may have strict lending limits, higher rates, and inflexible repayment terms. Where possible, try building some credit first before seeking wedding loans.

Conclusion

Prequalifying for wedding loans requires timely planning. You must also have disciplined budgeting and prudent borrowing. This could enable celebrations without burdensome debt. Before planning your dream wedding budget, assess your finances. Assess loan alternatives and compare offers by following this guide.