The Importance of Customization in Business Plans

A good business plan can secure funding and make the difference between success and failure. However, one size fits all is rarely effective when it’s true for convincing potential investors.

Industry experts say custom business plans boost the chance of success by 65%. Tailor your plan to the needs and expectations of your target investors. This shows a deep understanding of their priorities and your commitment to their success.

Investors are not evaluating your business idea, they’re assessing your ability to execute that idea. A customized business plan is a powerful tool to show your deep knowledge of the market, your vision, and your ability to handle challenges.

Understanding Your Audience

Before you tailor your business plan, first understand the diverse profiles of potential investors. Each investor category has distinct priorities and criteria for evaluating opportunities.

- Angel Investors: These wealthy individuals seek high-growth potential and exceptional teams. They’re often more risk-tolerant and value innovative ideas that can generate substantial returns.

- Venture Capitalists: Venture capital firms prioritize scalable business models with the potential for significant market disruption. They typically invest larger sums in exchange for equity stakes and focus on companies with a clear path to profitability.

- Banks: Financial institutions prioritize financial stability, proven track records, and lower-risk ventures. They seek comprehensive risk mitigation strategies and realistic financial projections that prove the ability to generate consistent cash flow.

Align your business plan with the interests of your target investors. This increases the chances of capturing their attention and securing the funding you need.

Key Components of a Tailored Business Plan

Business plans may vary in structure and emphasis. But, several key components are essential for tailoring your plan to secure funding. If you’re unsure about how to approach these components, consider seeking guidance from a business plan consultant who can provide expert advice tailored to your specific needs.

Executive Summary

The executive summary is your opportunity to captivate your audience and set the tone for the entire plan. It should encapsulate your business’s unique value proposition, market opportunity, and growth potential. Tailor this section to resonate with your target investors’ priorities, whether that’s disruptive innovation or proven stability.

Market Analysis

A comprehensive market analysis is crucial for demonstrating your understanding of the industry landscape, competition, and target customer segments. Investors seek businesses with a clear grasp of market dynamics, trends, and potential challenges. Customize this section to showcase your expertise and highlight the most relevant data for your target investors.

Company Description

This section should highlight your company’s unique selling points, vision, and competitive advantages. Emphasize the elements that align with your investors’ interests, whether it’s a revolutionary product, a strong intellectual property portfolio, or a seasoned management team.

Organization and Management

Investors are not only investing in your business idea but also the people behind it. This section should prove the capabilities of your leadership team, their relevant experience, and their ability to execute the business plan. Tailor this section to address the specific concerns and criteria of your target investors.

Marketing and Sales Strategies

A well-defined go-to-market strategy is essential for convincing investors of your ability to get and keep customers. Outline your marketing tactics, sales channels, and customer acquisition strategies. Make sure they fit the expectations and preferences of your target investors.

Product Line or Service

This section should articulate your product or service offering, emphasizing its unique value proposition and differentiating factors. Highlight the market needs and show how your offering addresses them and aligns with the interests of your target investors. It does not matter if it’s a disruptive innovation or a proven solution.

Financial Projections and Needs

Investors are primarily concerned with the potential return on their investment. Present realistic and data-driven financial projections, including revenue forecasts, expense projections, and funding requirements. Tailor this section to address the specific financial considerations of your target investors, such as desired growth rates, exit strategies, or cash flow visibility.

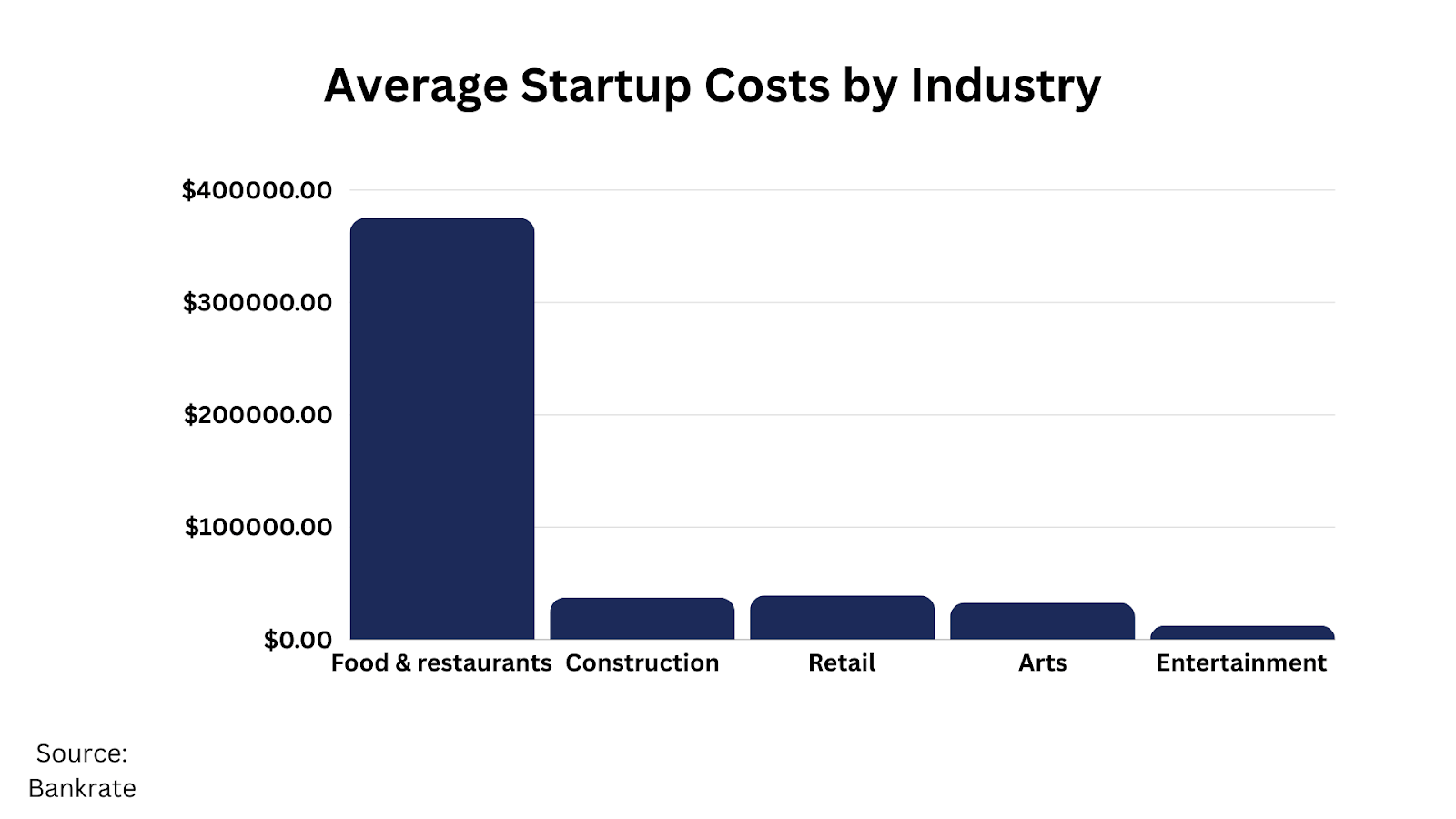

Leveraging Data and Market Research

Today’s business world runs on data and investors value clear evidence and market insights. Using data and doing market research can increase your business plan’s credibility and persuasiveness.

Data-backed claims have been shown to increase the credibility of business plans, according to industry experts. Incorporate relevant statistics, market trends, and industry benchmarks to substantiate your claims and demonstrate a deep understanding of your market.

Comprehensive market research boosts investor confidence by an impressive remark. Conduct an in-depth analysis of your target market, competitors, and consumer behavior to uncover valuable insights and validate your assumptions. This not only showcases your diligence but also demonstrates your ability to make informed, data-driven decisions.

Storytelling and Emotional Engagement

While data and analysis are essential components of a compelling business plan, the art of storytelling can elevate your presentation and leave a lasting impression on potential investors.

According to research, incorporating storytelling techniques can increase the memorability of your business plan. Weave a narrative throughout your plan that resonates with your target investors, painting a vivid picture of your vision, your journey, and the impact your business can have.

Additionally, emotional engagement has been shown to enhance investor trust. By tapping into the emotional aspects of entrepreneurship, such as passion, resilience, and purpose, you create a deeper connection with your audience and foster a sense of shared values and aspirations.

Risk Analysis and Mitigation Strategies

No business venture is without risk, and acknowledging potential challenges is essential for building investor confidence. By addressing risks and presenting clear mitigation strategies, you demonstrate foresight and preparedness.

According to industry reports, identifying and addressing risks early can prevent major financial issues and boost investor confidence. Additionally, presenting clear risk mitigation strategies has been shown to reduce investor concerns by a staggering 50%.

In this section, identify potential risks your business may face, such as market volatility, regulatory changes, or competitive threats. Outline specific strategies for mitigating these risks, including contingency plans, risk management protocols, and proactive measures to minimize exposure.

Design and Presentation Tips

While the content of your business plan is crucial, the way you present your information can impact its effectiveness and appeal.

Incorporating visual elements, such as charts, graphs, and infographics, has been shown to improve plan comprehension. These visual aids not only break up dense text but also help communicate complex ideas and data more effectively.

Attention to detail, consistent formatting, and a clean layout convey professionalism and demonstrate your commitment to excellence.

Consider using best practices for enhanced readability, such as:

- Clear headings and subheadings

- Short, concise paragraphs

- Bullet points for easy scanning

- Bold or italicized text for emphasis

- Whitespace for visual breathing room

- External links for additional resources

- Captions for visual elements

By valuing both content and presentation, you can create a business plan. It will be informative, and also visually appealing, and memorable.

Common Mistakes to Avoid

While tailoring your business plan to secure funding requires careful strategy and execution, there are common pitfalls that can undermine your efforts. Avoiding these mistakes can enhance the credibility and effectiveness of your plan.

One frequent misstep is failing to update your business plan regularly. As market conditions, trends, and your business goals evolve, it’s essential to keep your plan aligned with the current landscape. Neglecting to update your plan can make it appear outdated and diminish its relevance to potential investors.

Another common mistake is overlooking the importance of market research. Investors expect a deep understanding of your industry, target market, and competition. Without good market insights, doubts can arise. They can be about your business’s viability and your ability to navigate challenges.

Many entrepreneurs struggle to balance ambition and realism in their financial projections. Optimistic projections can hurt credibility. Conservative estimates may miss your business’s true growth potential.

Be aware of these pitfalls and addressing them can improve your plan. It will make it more convincing and of higher quality. This will raise your odds of getting the funding you need.

Comparison Table: Tailoring Your Business Plan for Different Investor Types

| Investor Type | Key Priorities | Tailored Approach |

| Angel Investors | High growth potential, Exceptional teams, Innovative ideas | Highlight disruptive innovation, Showcase team’s expertise, Emphasize scalability |

| Venture Capitalists | Scalable business models, Market disruption, Clear path to profitability | Focus on rapid growth strategies, Demonstrate market disruption potential, Outline exit strategies |

| Banks | Financial stability, Proven track records, Lower-risk ventures | Emphasize cash flow projections, Provide comprehensive risk analysis, Highlight existing revenue streams |

Tailor your business plan to the specific priorities of your target investors. Doing so will let you show the value of your business and boost your chances of getting the funding you need.

FAQs

1. How should I update my business plan to keep it relevant for potential investors?

Experts recommend reviewing and updating your business plan at least. Do so when big changes happen in your industry, market, or operations. This ensures that your plan stays aligned with current market conditions and trends. It also stays aligned with your changing business goals.

2. Can a strong business plan compensate for a lack of experience in my team?

While a strong business plan is essential, it should be complemented by a capable and experienced team. However, a good plan can show you understand the market. It can also show your strategic vision and ability to execute. Such a plan can help reduce worries about team experience a bit.

3. What is the most critical section of the business plan from an investor’s perspective?

All parts of the business plan are important. But, investors usually prioritize the financial projections, executive summary, and market analysis as the most crucial parts. These sections provide insights into the potential profit and growth of your business. They also cover the market understanding. These are key factors in their decisions.

Conclusion

Adapting your business plan to get funding is a strategic task. It needs a deep understanding of your investors, a full grasp of market dynamics, and a story that resonates with your audience.

This article outlines strategies. By using them, you can craft a business plan. It will showcase your venture’s potential and your commitment to investor success. Remember, a good business plan is more than a document. It’s a powerful tool. It can unlock the funding you need to make your vision real.